A similar edge provided by converging technical indicators arises when various indicators on multiple time frames come together to provide support or resistance. According to the developer, Bali is a scalping forex strategy, or at least, it is designed for short term time frames. However, the recommended timeframe is rather long, and so, signals are sent quite rarely.

Traders have to hold a position for several days and make a profit by swing highs and swing lows. + Position traders can take a hands-off approach while investing. This means you don’t have to track price charts and trends always. Forex strategies are reliable in helping you understand the market. Especially since there are so many different strategies to try out there! It is important to select trading strategies that have demonstrated success over time.

At the same best techniques for forex trading, their tails are always much longer than the ones of neighboring candles which is very easy to be noticed on the chart. One of the most popular and easy-to-use indicators helping to identify a new trend is a “moving average crossover” system. This indicator does not predict the future, but it helps to define the market movement. Drawing trend lines on the chart is one of the stress-free trading strategies. Link two low points if there is an uptrend and two high points if there is a downtrend.

Some traders like to incorporate simple indicators such as moving averages as they can help identify the trend. To scalp the markets, you need to have a short-term trading strategy along with an intraday trading mindset, and we have just the approach to help you with that. Generally speaking, it is always wise for beginners to trade with the markets, not against them.

Position Trading

But greater potential profits naturally come with greater risk. Price momentum can change rapidly and without warning, so swing traders must be prepared to react immediately when momentum changes. To mitigate the risks of holding their position overnight, swing traders will often limit the size of their position. Although a smaller position size curbs their profit margin, it ultimately protects them from suffering substantial losses. They rely on analytical data to identify trending markets and determine ideal entry and exit points therein. They also conduct a fundamental analysis to identify micro- and macroeconomic conditions that may influence the market and value of the asset in question.

- https://g-markets.net/wp-content/uploads/2021/09/image-5rvp3BCShLEaFwt6.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-sSNfW7vYJ1DcITtE.jpeg

- https://g-markets.net/wp-content/themes/barcelona/assets/images/placeholders/barcelona-sm-pthumb.jpg

- https://g-markets.net/wp-content/uploads/2021/04/male-hand-with-golden-bitcoin-coins-min-min.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-NCdZqBHOcM9pQD2s.jpeg

The benefits of price action trading is that your charts remain clean, and there is less risk of suffering from information overload. Having multiple indicators on your chart can send conflicting signals, which can lead to confusion, especially for beginners. There are many types of strategies that can be used to achieve financial freedom. One of those we didn’t discuss in this article was the fundamental analysis trading strategy. Overall Swing traders have the most success when first starting out to find the best trading strategy to make a living.

Carry trade strategy

Thanks to the leverage and Cent accounts, you can start with a minimum deposit of just $1. After two months of trading live on a demo account, you will see if your system can truly stand its ground in the market. This will give you a feel for how you can trade your system when the market is moving. Trust us, it is very different trading live than when you’re backtesting.

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

For example, some traders choose support and resistance levels as their targets. Economic indicators are one of the most important tools in forex fundamental analysis. These indicators provide information about a country’s economic health and can give clues about future currency movements. Some of the most important indicators for forex traders include the gross domestic product , inflation, unemployment, and retail sales. Forex fundamental analysis is the study of economic data and indicators to determine the future direction of a currency. It can be used to predict market trends, identify opportunities and make investment decisions.

There are some things that you need to be aware of to trade it correctly. And we have some key setups to show you, including the best strategy pdf and best forex trading strategy pdf. It can also be essential to check the news for such events as the oil supply and demand release each week. The Forex Market has a high level of price movement which means that there can be fakeouts.

The US dollar has been the centerpiece of the world economy since World War II, and its performance can have a ripple effect on the financial condition of other countries around the globe. From equities, fixed income to derivatives, the CMSA certification bridges the gap from where you are now to where you want to be — a world-class capital markets analyst. In the chart above, the red arrow shows a pinbar formed exactly on a support zone.

Question: What are the best trading strategy books?

The stronger your foundation of investing knowledge is, the more probable it is that you will make money from any effort to trade on the open market. This is because having a background in any field is beneficial in directing you along a road in that specific location. As a result, scalpers strive to maximize profits by making a large number of smaller gains. This strategy is the opposite of remaining in a position for hours, days, or even weeks.

What Are Crypto Trading Pairs? 4 Ways to Choose the Best Crypto … – MUO – MakeUseOf

What Are Crypto Trading Pairs? 4 Ways to Choose the Best Crypto ….

Posted: Tue, 29 Nov 2022 08:00:00 GMT [source]

A forex trading strategy is a set of analyses that a forex day trader uses to determine whether to buy or sell a currency pair. A forex trading strategy is a technique used by a forex trader to determine whether to buy or sell a currency pair at any given time. Like other day traders, they may also track economic events that are likely to impact short-term price movement. When determining your trading strategy, you will also have to consider how much money you will have to start with. The amount of money in your trading account can make a big difference as to what type of strategy would be best for you.

The keys to success in any company or money-making endeavor are planning and knowledge. No matter how motivated and determined you are, or how much money you want to invest, your efforts to make a successful financial choice will always end in failure and tragedy. To determine where to enter or leave the trade, you must analyze price movements.

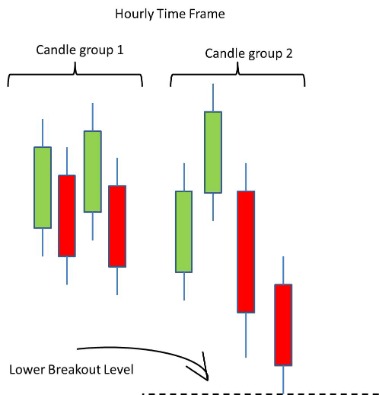

A common decision among https://g-markets.net/rs is setting a 3% daily risk limit. Choosing a time frame that suits your trading style is very important. For a trader, there’s a huge difference between trading on a 15-min chart and a weekly chart. If you are leaning more towards becoming a scalper, a trader that aims to benefit from smaller market moves, then you should focus on the lower time frames e.g. from 1-min to 15-min charts. Before we proceed to discussing the most popular Forex trading strategies, it’s important that we understand the best methods of choosing a trading strategy.

At the end of the test, you can start trading with it on your live account. Keep your emotions in check, follow your strategy strictly, and let the numbers work in your favor. Regardless of how good they look, ALL strategies will have losing trades. Spend as much time as possible evaluating each one in backtests to see what works and what doesn’t. The red arrow in the image shows the squeeze while the green arrow signifies the breakout.

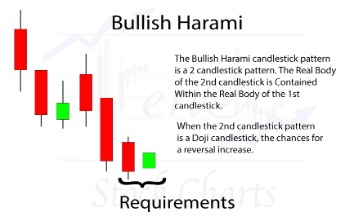

It’s a simple and, at the same time, very effective trading strategy for beginners. It all comes down to determining a combination of three candles. You can work on any timeframe, but remember that the higher the chart interval is, the more accurate the Price Action signals will be.

Because swing trading demands quick action and close market oversight, it’s typically favored by day traders who are available to monitor changes in price momentum minute to minute. Despite being classified as a short-term trading strategy, this approach demands that traders hold their position overnight and may keep them in a trade for a few weeks at a time. The following forex trading strategies are utilised by traders to provide structure to their trading efforts. These strategies are not specifically designed for forex markets but are rather general strategies that can be applied to all financial markets. The strategy you decide on will correlate to the type of trader you are. Open an account to start practising your forex trading strategies via spread bets and CFDs.

Also, many trading systems are designed to engage the same market conditions, only with much smaller risk and reward parameters. + Day traders use short-selling trading strategies to take advantage of falling stock prices. Another way to exit is to have a set target, and exit when the price hits that target.